USD: The Inertia of Incumbency

:economics:geopolitics:

Pretext

The United States is widely recognized as a superpower due to its abundant natural resources, formidable economic strength, unparalleled military capabilities, resilient political institutions, and cutting-edge technological innovation; all forged along a historical path that has established it as the preeminent global power since the mid-20th century. Without getting out of scope, I provided a summary table highlighting the factors that allow the US to establish its hegemonic status:

|

Category |

Key Points |

References |

|---|---|---|

|

Geographic and Demographic Advantages |

|

a |

|

Economic Strength |

| |

|

Military Superiority |

| |

|

Political Influence and Institutions |

| |

|

Innovation and Technology |

| |

|

Historical Context |

|

In USD we trusted

While all the above are certainly true, the primary reason allowing the United States to sustain its status for nearly a century depsite many challenges is, you guess it, USD.

The US dollar has maintained its position as the world's primary reserve currency for nearly eight decades, despite persistent cyclical challenges to its hegemony. As of 2024, approximately 58% of global foreign exchange reserves and 90% of energy transactions remain denominated in USDgh, even as geopolitical rivals like the BRICS bloc attempt to create alternative financial architecturesi. This resilience stems from historical path dependency established through the Bretton Woods systemj, strategic petrodollar agreementsk, and depth in liquidity and institutional trustl. While the US debt crisis and geopolitical shifts have prompted debates about de-dollarizationh, the absence of viable alternatives with comparable market depth, relative political stability, and network effects continues to reinforce dollar dominancejh.

In this article, we will briefly explore the origin of the USD-based monetary architecture, its structural advantages, its ongoing challenges by dissecting the intrinsic tie between USD and the US hegemonic status.

The Bretton Woods System: Post-War Monetary Architecture

The 1944 Bretton Woods Conference established the USD as the anchor of the international monetary system, pegging it to gold at $35/ounce while other currencies fixed their exchange rates to the dollarmj. This institutional framework emerged from unique historical circumstances:

- The United States held two-thirds of global gold reserves after WWIIl

- European and Asian economies needed dollar liquidity for reconstructionn

- The system created built-in demand for USD as central banks maintained dollar reserves to stabilize exchange ratesjl

The International Monetary Fund (IMF) and World Bank – created at Bretton Woods – further entrenched dollar centrality by denominating loans and quotas in USDj. These institutions are instrumental in solidifying the modern global financial order with the USD at its center. During the world wars and the post-war era, historical literature and data depict a nuanced and gradual transition from sterling to the US dollar as the dominant reserve currencyop, marking the beginning of unipolar dollar-based era.

The Nixon Shock and Transition to Fiat Currency

Perhaps the most significant event in modern monetary history is President Nixon’s 1971 suspension of gold convertibilityqr, signifying a pivotal shift to fiat currency, with the dollar’s value now ultimately resting on three pillars:

- The Federal Reserve’s monetary credibility

- Strategic agreements with oil-producing nations

- Continued use as the primary invoicing currency in global tradeks

This decision responded to the depletion of US gold reserves from 20,000 tons in 1950 to 8,333 tons by 1971, as foreign nations like France increasingly redeemed dollars for goldql. The move severed the dollar’s formal link to gold but inadvertently strengthened its global role through subsequent petrodollar agreementsk.

The Petrodollar System

The 1974 US-Saudi pact required oil sales in USD, creating self-reinforcing demand cyclesks:

- Oil importers needed dollars for energy purchases

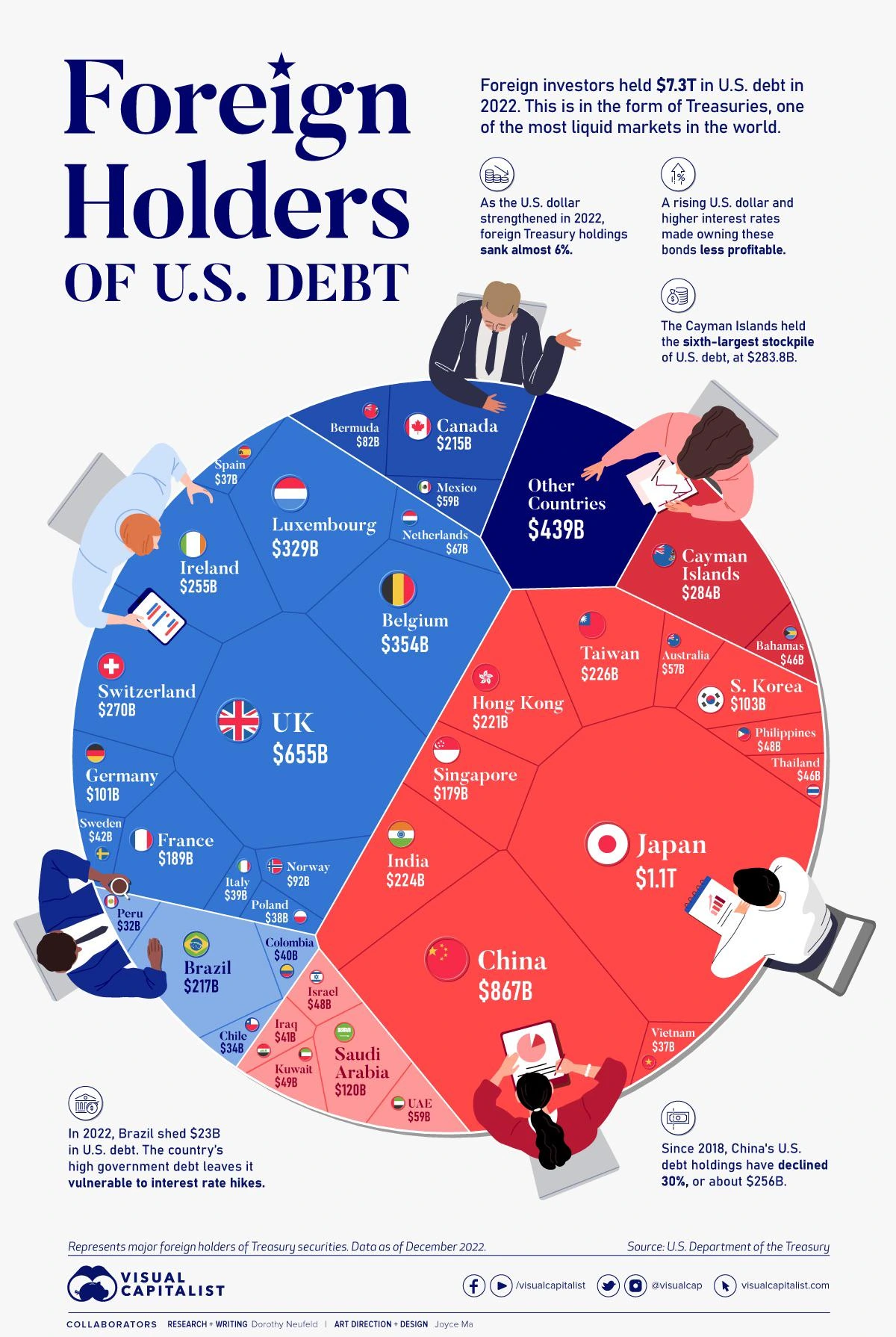

- Exporters reinvested surplus dollars in US Treasuries

- This "recycling" mechanism deepened dollar liquidity pools

By 1980, 85% of global oil trades used USD, making it indispensable for energy marketss. This system transformed the dollar into a quasi-commodity currency, with its value indirectly backed by the world’s most traded physical commodity. As fossil fuel is the foundation of modern societyt, the US Dollar continues to be the foundation of global financial system.

Structural Advantages Sustaining Dollar Primacy

Liquidity and Network Effects

The USD benefits from unmatched market depth:

- $7.5 trillion daily turnover in forex markets, with the USD involved in 88% of all trades (2022 data)u

- 60% of global debt securities denominated in dollarsv

- 50-70% of international trade invoices use USDw

This liquidity creates powerful network effects – businesses and nations use dollars because others do, minimizing conversion costs, further reinforcing dollar dominance.

Institutional and Legal Frameworks

The US provides critical infrastructure for global finance:

- Rule of law for contract enforcement

- Deep capital markets with $53 trillion in financial assetsx

- Central bank swap lines to ensure global dollar liquidity eg. During the 2020 COVID crisis, Federal Reserve swap lines provided $450 billion in liquidity to 14 central banks in effort to stabilize financial markets by providing foreign central banks with access to US dollars, demonstrating the dollar’s role as the global lender of last resortyz

Challenges to Dollar Dominance

The US Debt Crisis

As of 2024, the US federal debt stands at approximately 121% of GDPα, marking the highest level of public debt ever recorded in peacetimeβ, underscoring ongoing concerns about fiscal sustainabilityγ. According to the 2024 Financial Report of the United States Government, under existing assumptions, the debt-to-GDP ratio is projected to exceed 200% by 2049 and reach over 500% by the end of the century, driven by persistent primary deficits and rising interest costsδ. This trajectory implies that without policy changes, debt would grow faster than the economy indefinitely, imposing increasing burdens on future generations.

The ability to meet one's debt obligations is crucial not only for individuals but also for governments. Therefore, the U.S. debt crisis is closely linked to the status of the US dollar as the world's reserve currency. Historically, the dollar has been considered a "safe haven" asset, meaning global investors rely on U.S. Treasury bonds for stability. However, as US debt levels rise, concerns about fiscal sustainability are growing, leading to increased borrowing costs and potential economic instability. This could trigger a corrosion trust in the dollar-based financial system.

At what debt-to-GDP level does the first domino fall, potentially triggering a cascade that topples the unipolar, dollar-based global order? That question, debated by researchers worldwide, warrants a book-length exploration and is far beyond the scope of this article. However, in short, political and economic factors greatly complicate the path forward. While precise thresholds are elusive, the U.S. faces immediate fiscal challenges. In 2025, the US must navigate the debt limit, appropriations deadlines and expiring tax cuts, all within a context of substantial deficits and a narrowly divided Congress, making timely and sustainable fiscal adjustments extremely uncertainε. This political gridlock, coupled with rising debt, could create the conditions for a future fiscal crisis. As the Hoover Institution notes, America's debt is approaching levels that may trigger market panic, financial crises, and deep recessionζ. As Moody's downgrade of the US's credit rating signals, this is more than just a technical market event; it represents an emerging consensus that the United States' mounting debt burden has shifted from an abstract risk to a strategic constraint on U.S. power and leadershipη.

Despite these high debt levels, several factors help mitigate risks to the dollar’s long-term stability:

- Approximately 65% of US dollars in circulation are held overseas, which externalizes inflation risks beyond the domestic economyθ.

- The US Treasury market remains the global safe asset benchmark, supported by unmatched liquidity and depthι. As of May 2025, no other bond market approaches the $28.6 trillion size of the US Treasury market, reinforcing its central role in global financeκ.

Foreign confidence in the dollar remains relatively strong, as evidenced by foreign holdings of US Treasuries increasing to about $8.5 trillion in December 2024λ, reflecting sustained demand for dollar-denominated assets despite debt concerns.

The Unintended “Sell America” Trade

President Donald Trump’s confrontational economic policies arguably undermined global trust in the US institutions; and by extension US assets including the dollar. His aggressive tariff impositions and political pressure on the Federal Reserve challenged the Fed’s independence, creating uncertainty and volatility across financial marketsμ. This turmoil led to a rare "sell America" trade, with simultaneous sell-offs in US stocks, bonds, and the dollar itself, which fell to a three-year low, reflecting a crisis of trustμν.

No Real Alternative Has Emerged

Despite growing skepticism about the US hegemonic status and efforts by emerging powers to challenge it, no viable alternative has yet materialized to rival the dollar’s global dominance, at least in the short term.

Limitations of BRICS De-Dollarization Attempts

The BRICS bloc - comprising Brazil, Russia, India, China, and South Africa - has made limited but strategic progress in challenging the dominance of the US dollar in global finance. Despite ambitious rhetoric, structural and political constraints have limited the effectiveness of these efforts.

| Initiative | Status (2024) | Key Limitations | Reference |

|---|---|---|---|

| Contingent Reserve Argeement | $100 billion pool | Requires unanimous votes; limited operational flexibility | ξο |

| New Development Bank | $50 billion capital | Approximately 70% of loans denominated in USD; limited currency diversification | ξπ |

| Local Currency Trade | Alternative to SWIFT | Still largely reliant on USD settlement and pricing mechanisms | ρσ |

While de-dollarization makes compelling headlines, JP Morgan suggests that transactional costs of transitioning to a multi-currency system (estimated at 1.5% of global GDP annually)τ would ensure continued dollar primacy.

The Euro’s Limitations

The euro accounts for approximately 19.83% of allocated global foreign exchange reserves as of Q4 2024, making it the second-largest reserve currency after the US dollarυ. However, several structural challenges limit its potential to fully rival the dollar:

- Fragmented sovereign debt markets across the Euro Area create risks of financial instability and contagionφ.

- The absence of a unified fiscal authority hinders coordinated economic policy and the issuance of common Eurobondsχ.

- The daily forex turnover for the euro is significantly lower than the US dollar, which impacts its liquidity and global usabilityψ.

While the Euro Area's foreign exchange reserves totaled approximately $101.33 billion USD in April 2025ω, these structural factors continue to prevent the euro from functioning as a true alternative reserve currency.

The Yuan’s Structural Hurdles

Despite being the world's largest trading nation, China's yuan (renminbi) constitutes only 2.18% of allocated global foreign exchange reserves as of Q4 2024, according to the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) dataυ. Several factors constrain its internationalization:

- Capital account restrictions and limited currency convertibility constrain yuan internationalizationa1.

- The People’s Bank of China lacks full independence, raising concerns about monetary policy credibilitya1.

- Geopolitical distrust of the Chinese Communist Party’s governance and transparency further limit global acceptanceb1c1.

- Only about 3% of global trade invoices are denominated in yuana1.

- Offshore yuan bond issuances surged in 2024, reflecting progress but still limited global penetrationd1.

Precious Metals and Digital Assets

Precious metals, particularly gold, with its role as a safe-haven asset and a hedge against currency devaluation, inflation, and geopolitical instability, remain a store of value but lack the liquidity and scalability to serve as a global reserve currency alternative. With that said, it is important to point out central banks worldwide have been significantly increasing their gold purchases in recent years, continuing this trend strongly into 2025. They have accumulated over 1,000 metric tons of gold annually for each of the past three years, more than doubling the average of 400–500 tons per year seen in the previous decadee1f1. BRICS nations collectively hold significant gold reserves (about 5,700 tonnes), representing 16% of global gold reserves, but this has yet to translate into a coordinated gold-backed currencyg1h1i1.

Cryptocurrencies such as Bitcoin reached a market capitalization of approximately $1.2 trillion in 2024 and have been gaining momentum on institutional adoption j1. Though that is quite an impressive milestone, the relatively small scope recognition of institutional backing and regulatory uncertainties limit their utility as reserve assets. Bitcoin’s volatility remains extremely elevated in comparison to the US dollar.

Latest 90-day annualized volatility for Bitcoin: 42.53% Latest 90-day annualized volatility for US Dollar Index: 9.29%

Central Bank Digital Currencies (CBDCs) show promise for enhancing payment efficiency and financial inclusion, but none have yet achieved the scale or trust necessary to challenge the dollar’s dominancek1l1.

Final Words

As in 1944, the world economy still needs a coordination mechanism – and no successor has replicated the network effects that make the USD the least bad option. The BRICS' fragmented efforts and the euro's and yuan's structural flaws confirm that dollar dominance still remains the path of least resistance in global finance.

Ultimately, it has been emphasized that the greatest threat to the dollar is not external competition but the erosion of trust in US political and legal institutions. The dollar’s strength relies on faith in the rule of law, contract sanctity, central bank independence, and democratic stability. Trump’s policies and rhetoric strained these foundations, raising concerns about the dollar’s long-term dominance despite the absence of viable alternativesμm1.